Strategies that Drive Growth and Value

Research shows that a strong performance culture can significantly impact financial growth, particularly in terms of EBITDA. In fact, companies with high cultural alignment tend to have up to four times higher EBITDA growth compared to those without. Strong performance cultures are also linked to higher productivity, lower employee turnover, and more consistent customer satisfaction, all of which contribute directly to profitability.

In the fast-paced world of private equity, these metrics support creating solid performance cultures within portfolio companies, accelerating the path to increased exit valuations and significantly higher returns.

In our latest LinkedIn Live Event: Building a Performance Culture Within Portfolio Companies, we got an exclusive look inside the processes and mindsets behind the dynamic performance culture of Podium Entertainment, a portco led by Scott Dickey, an industry-leading CEO who has operated primarily in the private equity sector for 20+ years. Scott, together with Transcend CEO Craig Wiley and senior executive coach and strategist Jaci Reed, discussed how to foster a results-driven culture that aligns with investment goals, empowers leadership teams, and improves operational efficiency and value creation, specifically in the private equity space.

Below, we’ll highlight the most actionable tools and strategies from the webinar; valuable insights for any leader looking to improve performance within their organization.

What Does Performance Culture Look Like in Private Equity?

At its core, private equity is an environment built to win. Investors, firms, executives, and talent may each have different motivations, but they are all driven to succeed. So, the question becomes, “What does it mean to create a performance culture where everyone can win, whatever their motivation?”

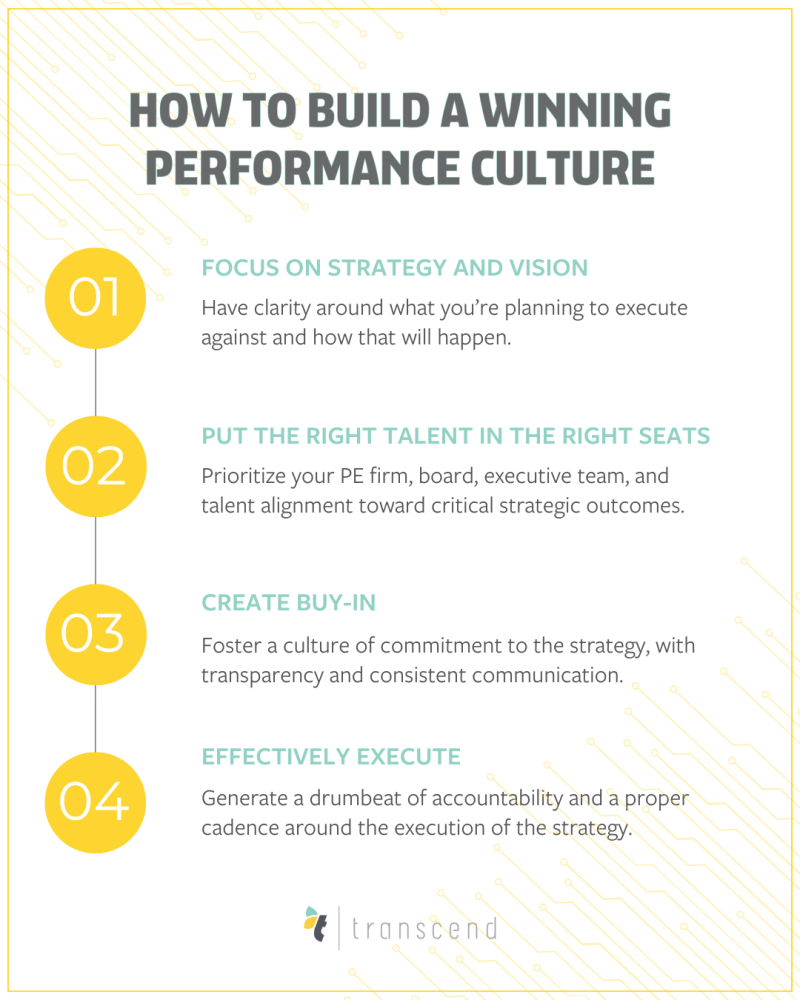

The answer lies in understanding how to get an entire organization pointed in the same direction by aligning priorities and focusing on what matters most. Teams who are spreading themselves thin by trying to do too much will never get to the finish line. Here’s how to ensure your team is aligned to the collective win:

To win in private equity, sacrifices must be made as a team. Every muscle needs to work together to move the enterprise forward faster and with more accuracy than ever before.

Every movement matters. Are you making the right ones?

The Importance of Vision

To build highly effective teams, the CEO must have a clear vision of the company’s future. It is especially vital to value creation in a business environment where decision-making and expectations for results operate at lightning speeds. Often, in the private equity arena, the idea of establishing a clear vision can be disregarded and misunderstood as something that won’t drive rapid deliverables. However, we see vision as the North Star for value creation — it’s how the investment thesis comes to life in the market for the consumer, the industry, and the employees. When we know what success looks like, we can make better long-range decisions while managing the 30-60-90-day sprints to drive performance. With a true purpose, the right decisions will compound over time to get the enterprise to the next-level horizon.

A company’s vision is not a one-size-fits-all statement, but rather the purpose that drives employees and stakeholders to commit to the strategy and be accountable to a unified mission. A cultural shift takes place when there is a collective buy-in to a larger purpose that everyone can rally around, creating the momentum and engagement necessary to get the job done.

For that kind of momentum to take place, the vision has to be something that the entire organization can develop together and collectively embrace, rather than something they’re told to execute under. When people are connected to the vision at that level, they will be crystal clear on the mission and use it as a guiding light for making the right decisions, freeing up the organization to move at a much faster pace. It allows people from different verticals to align under a shared purpose, collaborate, and move the business forward.

Regular Communication

Creating a cadence agile enough to keep up with the rapid pace of a portfolio company is essential for bringing the strategy to life and keeping the vision in focus. Empower next-level leaders to own execution initiatives and use the following check-in cadence to support quick and consistent decision-making.

- Initiative Execution: Minimum biweekly connection within initiative teams to discuss status, troubleshoot roadblocks, and celebrate wins.

- Executive Team Progress: Minimum bimonthly connection between the executive team and initiative leaders to report progress and challenges and discuss resource needs. This helps the executive team make strategic decisions and provide updates to the board.

- All-Hands Updates: Minimum monthly update to the entire organization about strategic progress and key decisions. This can be replaced with more frequent communications about singular initiatives as needed.

- Strategy Refresh: A yearly connection to reset the near-term strategy and review the long-term strategy relevant to current market conditions.

As a portco CEO, implementing the right cadence to meet with your board and PE partners is also essential. Setting up regular connections (the more often, the better) to discuss what’s happening in the organization makes it easier to align on challenges and opportunities. This also generates buy-in with partners and allows for valuable independent voices to be heard and involved in critical decisions. Transparency and consistency of communication establish the engagement necessary to foster performance.

Beyond cadence, adopting an enterprise-first executive team mindset, especially when dealing with multiple initiatives across teams, is essential to a successful performance culture and strategy execution. This means that executive-level leaders have a singular and collective focus on the needs of the enterprise before their team or individual needs—enterprise, team, self. Thus begins a trickle-down effect of enterprise collaboration throughout the company, empowering next-level leaders and their teams to execute the vision and strategy without question.

Investing in Teams

One of the most important aspects of any business is investing in the right talent to get you to the goal line. In a performance culture, people have to be willing to go the extra mile in terms of commitment to the goal. As a portco CEO, you must understand the capability and capacity of your talent to execute and build your team around the company of the future.

There are times when doubling down on investing in teams within private equity environments is critical:

- When resourcing initial teams — Bring the right people together early on to understand the organization’s goals and adopt the vision.

- When onboarding mission-critical talent — Do this as efficiently and effectively as possible so these people can make maximum impact quickly.

- When going through an integration — This is a critical time to align leadership for the best chance at success.

Especially in the modern era of longer hold times for investments, CEOs have to carefully thread the needle between overinvesting and lacking the capacity needed to drive organic growth. They must bring the organization up to just the right speed so that growth, scale, and capacity stay steady and under control. Transparency, cadence, and building a collaborative strategy all help create the tight alignment and speed of execution that is necessary to accelerate or slow the pace of business as needed.

For PE firms that are investing in a new portfolio company, be cautious of dismantling management teams too quickly. The existing team has an inherent knowledge of the industry, company, product, or service that got them to where they are. Making wholesale changes too quickly is a surefire way to eliminate momentum and create fear and a lack of trust in the team members that remain. Instead, consider who is critical to replace right away and who on the existing management team should be engaged in the process of creating the vision. Once the dust settles, further decisions for capability and capacity can be determined.

A Game of Forward Momentum

Business is a game of forward momentum driven by action. Fostering an environment of experimentation empowers players to act—testing, iterating, and making decisions at all levels. The ability to lean into new ideas without the fear of making mistakes leads to increased engagement, constant innovation, and speed. This approach generates the energy required to sustain high performance.

Keep in mind that action has to be consistent with strategy. The CEO’s job is to provide the vision, implement the strategy, and set up the infrastructure necessary so people can make decisions that point the company in the right direction. If something goes wrong, open communication and a strong feedback culture enable the organization to get back on its feet more quickly.

Key Takeaways

Sustained growth and maximum returns for PE firms start with portfolio company cultures that are aligned under a unified mission.

Building a performance culture within portfolio companies is a powerful driver of value creation and accelerated growth, especially in the private equity space. A thriving performance culture is reliant on the people who make it run, so be mindful of investments in talent and leadership and inspire a purposeful vision for the company that all can embrace. With the proper cadence around strategy initiatives and performance, the momentum and speed needed to reach the next pillar will take hold, freeing up talent to engage in empowered decision-making and the innovation that naturally follows.

If you want more ideas on how to build a high-performing culture within portfolio companies, watch the full webinar here or contact Transcend to get in touch with one of our strategy experts.