Accelerated Growth SolutionsPrivate Equity & Principal Investors

We activate transformation in companies and the people who lead them

Private equity firms face unique challenges in aligning executive leadership, nurturing talent, fostering organizational culture, and driving accelerated outcomes amidst rapid growth.

At Transcend, we specialize in supporting private equity firms and their portfolio companies through this critical phase of growth and transformation. Our holistic approach combines leadership and strategy coaching with organizational development initiatives, enabling us to amplify the performance of both individuals and teams while cultivating a cohesive, future-focused culture.

Jump To:

Faster Growth

Starts Here

- Listen: Podcast episode with our CEO Craig Wiley on how our proven approach works

faster than traditional strategy consulting:

How our proven approach accelerates growth and increases leadership performance at scale

Dealexecution

Transcend utilizes the Value Creation Performance System to rigorously evaluate targeted investments, providing a comprehensive view of leadership and tactical risks, opportunities, and transformations that inform deal negotiation, structure and post-acquisition strategy.

Portfolio companyoversight

Transcend guides Portfolio companies through a proven proprietary process, engaging relational and tactical transformations to create strategic growth, enhanced performance, optimized operations, and sustained profitability.

Fundraising &investor management

Transcend empowers private equity firms to attract investors seeking superior financial outcomes. We help firms crystalize and communicate a differentiated performance narrative that optimizes opportunity, minimizes risk and elevates investor transparency.

Firmoperations

Transcend enhances Firm performance by aligning the partners to a strategic growth plan, guiding its execution and maximizing profit to bolster partner confidence and interconnection

A trusted PE partner with a track record that speaks for itself.

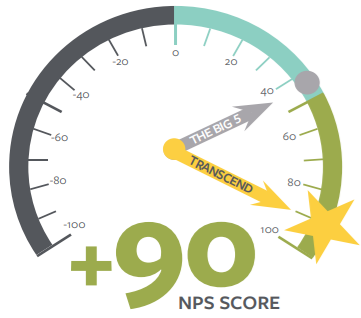

Over the past two decades, we’ve worked closely with leaders across various industries, consistently delivering impressive results with ROIs exceeding 6x and an average Net Promoter Score of +91. Our secret sauce lies in our relational and tactical blend of services, which have proven to enhance transparency, amplify motivation and leadership, and drive accelerated outcomes through stakeholder alignment and operational excellence.

* Based on surveys of CEO clients across industries

Private Equity

Case Studies

Proof points of our success working with PE firms and their portfolio companies across industries and various sizes

Click on a case study to read more:

Portco Transformation: $22M to $55M with 9x ROI

Challenge: Entertainment production company with single YOY revenue lacking a growth strategy with over dependence on founder leadership.

Solution: Crystallized an emerging executive team into an effective, highly collaborative unit that could scale brand differentiation, market capture, client service, and technology solutions with fidelity and speed.

Results: Successful exit within 48 months with a $55M top-line evaluation with multiple bidders due to brand and cap.

Portco Transformation: From start-up to industry disrupter with

20% lift in organic-driven CAGR

Challenge: Tech start-up in an established consumer products segment with 2 failed exit attempts and lack of differentiation.

Solution: Developed and implemented a transformation strategy to drive accelerated growth, solidify market differentiation, embed capabilities to scale, and prepare for a successful exit followed by rapid expansion through acquisition.

Results: Within 18 months, 28% YOY top-line growth, 225% increase in production output, and positioned to sell within 12 months.

PE Management firm optimization: Increased firm efficiency and grew brand attraction

Challenge: Three powerhouse PE partners united to engage in creating the first fund, but lacked the structure and rigor to improve firm and portfolio performance.

Solution: Built firm performance and ops improvements across fundraising and investor management, deal sourcing, origination, and

execution; elevated due diligence and portco oversight capabilities to include 8 areas of value creation and post-acquisition best practices.

Results: Rapidly becoming the PE partner of choice in luxury consumer products segments through the fourth deal closure; scaled operations and roles ensured an early anchor investor commitment for the second fund.

Portco Transformation: $22M to $55M with 9x ROI

Challenge: Entertainment production company with single YOY revenue lacking a growth strategy with over dependence on founder leadership.

Solution: Crystallized an emerging executive team into an effective, highly collaborative unit that could scale brand differentiation, market capture, client service, and technology solutions with fidelity and speed.

Results: Successful exit within 48 months with a $55M top-line evaluation with multiple bidders due to brand and cap.

Portco Transformation: From start-up to industry disrupter with

20% lift in organic-driven CAGR

Challenge: Tech start-up in an established consumer products segment with 2 failed exit attempts and lack of differentiation

Solution: Developed and implemented a transformation strategy to drive accelerated growth, solidify market differentiation, embed capabilities to scale, and prepare for a successful exit followed by rapid expansion through acquisition

Results: Within 18 months, 28% YOY top-line growth, 225% increase in production output, and positioned to sell within 12 months

PE Management firm optimization: Increased firm efficiency and grew brand attraction

Challenge: Three powerhouse PE partners united to engage in creating the first fund, but lacked the structure and rigor to improve firm and portfolio performance.

Solution: Built firm performance and ops improvements across fundraising and investor management, deal sourcing, origination, and

execution; elevated due diligence and portco oversight capabilities to include 8 areas of value creation and post-acquisition best practices.

Results: Rapidly becoming the PE partner of choice in luxury consumer products segments through the fourth deal closure; scaled operations and roles ensured an early anchor investor commitment for the second fund.

Transforming Executive & Company

Performance for Over 20 years

Let the journey begin!

Schedule a free consultation and take your first step towards transforming your leaders.

"*" indicates required fields

Faster Growth

Starts Here

- Listen: Podcast episode with our CEO Craig Wiley on how our proven approach works